Understanding UK Mortgage Rates: A Guide for Homebuyers

What are Mortgage Rates?

Mortgage rates are the interest rates charged by lenders on home loans. These rates fluctuate over time, impacting the monthly payments you'll make on your mortgage.

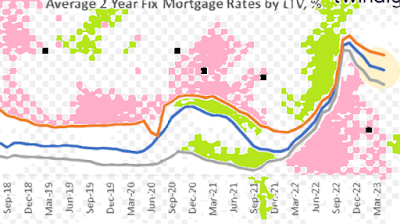

Current Mortgage Rates in the UK

As of November 2023, UK mortgage rates have been on the rise due to economic factors. However, there are still competitive rates available. To get the most accurate and up-to-date information, consider using a mortgage comparison website or consulting with a mortgage advisor.

Factors Affecting UK Mortgage Rates

Several factors influence mortgage rates in the UK:

Bank of England Base Rate: The Bank of England sets the base rate, which directly impacts mortgage rates.

Inflation: High inflation can lead to increased interest rates to curb rising prices.

Economic Conditions: Economic stability and growth influence lenders' decisions on interest rates.

Lender's Risk Assessment: Lenders assess your financial situation to determine your risk profile and offer appropriate rates.

Types of UK Mortgages

Fixed-Rate Mortgages:

Offer fixed interest rates for a specific term (e.g., 2, 5, or 10 years).

Provide stability in monthly payments.

Less flexibility in adapting to potential rate drops.

Variable-Rate Mortgages:

Interest rates fluctuate based on the Bank of England base rate.

Potentially lower initial rates.

Higher risk of increased monthly payments due to rate rises.

Tracker Mortgages:

Interest rates track a specific index, often the Bank of England base rate, with a margin added.

Can offer competitive rates.

More sensitive to base rate changes.

Tips for Finding the Best Mortgage Rate

Shop Around: Compare offers from different lenders to find the best deal.

Improve Your Credit Score: A good credit score can lead to lower interest rates.

Consider a Larger Deposit: A higher deposit can make you a less risky borrower.

Use a Mortgage Broker: A broker can help you find the most suitable mortgage and negotiate better rates.

Stay Informed: Keep track of economic trends and interest rate movements.

Understanding UK mortgage rates is crucial for making informed decisions when buying a home. By considering the factors affecting rates, choosing the right mortgage type, and following the tips provided, you can secure a competitive mortgage and achieve your homeownership goals.

UK mortgage rates

mortgage rates UK

UK mortgage interest rates

UK home loans

UK property market

fixed-rate mortgage UK

variable-rate mortgage UK

tracker mortgage UK

mortgage broker UK

mortgage comparison UK

first-time buyer mortgage UK

remortgage UK

buy-to-let mortgage UK

Bank of England base rate

mortgage affordability calculator

mortgage payment calculator

best mortgage deals in the UK

how to get a mortgage in the UK

how to choose a mortgage

what affects mortgage rates in the UK

how to reduce mortgage payments

how to improve mortgage credit score

mortgage advice UK